Of course that's nothing but nonsense that just sounds good to people who know little about how economics work. The fact of this matter is that the middle and lower classes both create and consume the jobs. How? The middle class creates the demand for a product or service and the owner then responds by creating jobs in order to meet that demand. These people having more money has little to do with the creation of jobs and the reality is , jobs are created by smaller moderate profit companies.

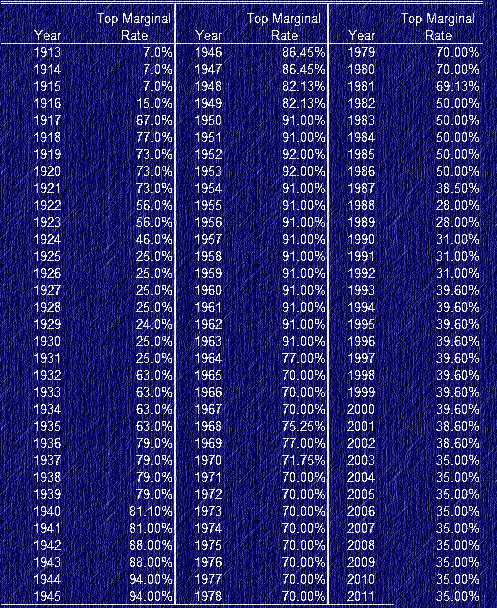

In 1922 under President Warren Harding(Republican) the tax rate on top earners began to go down and by 1925 under President Calvin Coolidge and 69th Congress(Republican) the tax rate on top earners dropped from 46% to 25%. This was one of the leading causes of the "Roaring Twenties" ,which in simple terms was economic bubble that ultimately popped when it was painfully seen that demand for products and services were non-existent as most of the money had gone to the top 2% of the country.

In 1933 During the first 100 Days of Franklin Roosevelt's term the tax rate on High Earners increased to 63%. In the Next few years sweeping legislation such as The Glass–Steagall Act , Robinson–Patman Act , and Fair Labor Standards Act of 1938 were passed.

In 1941 The United States entered World War II accelerating the recovery because we now had a Minimum wage , the right to unionize, and regulation on the businesses that caused most of the problem. America Thrived for a few decades with a strong middle class

|

| Chart illustrates Historical tax rates (Source) |

Fast forward to 1981 under President Ronald Reagan the tax rate is reduced to less than 70% for the first time since 1938 and by 1988 it takes a dive to below 30%. This inevitably starts the same kind of reaction we had in the 1920's where businesses grew at an exponential rate while wages remained stagnant and the cost of living increased. They still however had those pesky regulations holding back profits and in 1999 The Glass–Steagall Act was repealed and now in 2011 rights of unions are under attack and we stand with a potential budget deal that brings the tax rate back to 1929.

Where can it go from here?

No comments:

Post a Comment